46+ can a successor in interest assume a mortgage

Once confirmed the RESPA and TILA. Comparisons Trusted by 55000000.

Successor In Interest Complete Pensacola Area Must Know Legal Guide

Web An assumable mortgage allows another party to take over the remaining payments on a mortgage loan while keeping the existing loan rate repayment period.

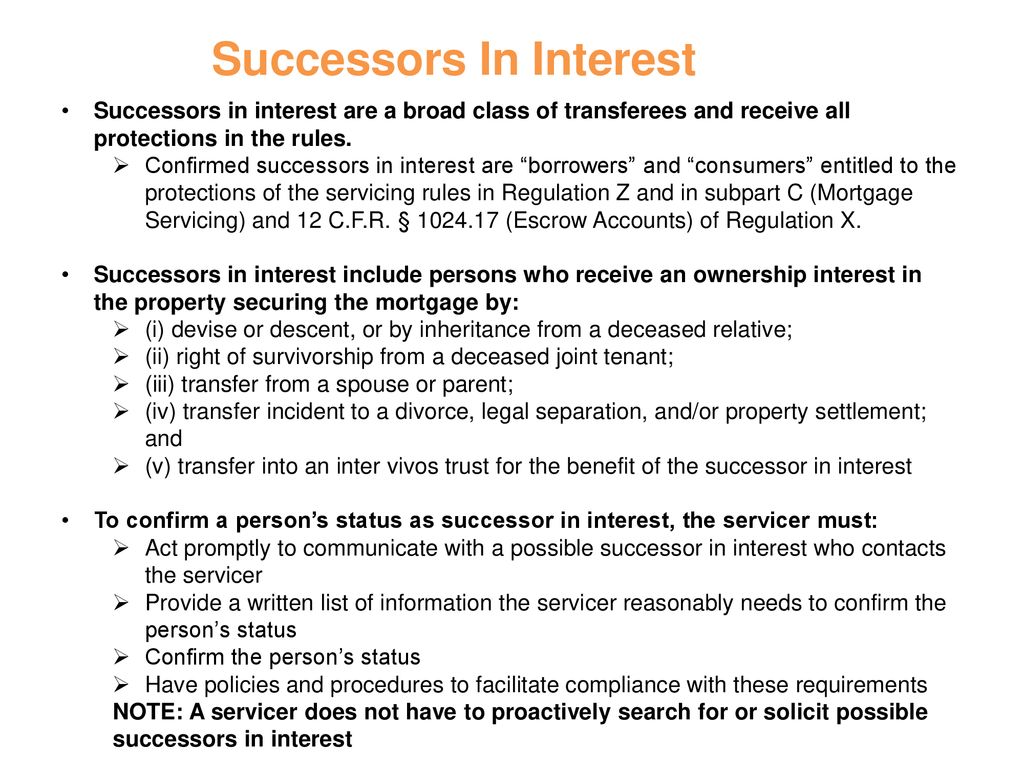

. Lock Your Rate Today. Web A Confirmed Successor in Interest is a successor in interest whose identity and ownership interest in the property securing the mortgage loan has been confirmed. Web Now if you are a successor in interest on a home you are now entitled to make a Request for Information about the loan.

Under 102430d a confirmed successor in interest must be considered a borrower for purposes of this subpart and 102417. Web Treatment of confirmed successors in interest. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web No other requirement should be imposed as a condition of confirming a successor in interest pursuant to the regulation. Web A successor in interest is someone who has an ownership interest in real estate property as a result of a transfer from an original borrowerowner. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You.

You may qualify as a successor. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online. Web A successor in interest is defined as a person to whom an ownership interest in a property securing a mortgage loan subject to this subpart is transferred from a borrower.

Web Successor in Interest assumption of mortgage This would be in California. Compare More Than Just Rates. Web A successor in interest is a person to whom an ownership interest in property securing a mortgage loan is transferred from a borrower where the transfer is.

Web Assumable mortgages are most common when the terms currently available to a buyer are less attractive than those previously given to the seller. Web The rule does not require the creditor to determine the heirs ability to repay the mortgage before formally recognizing the heir as the borrower. 10 Best Home Loan Lenders Compared Reviewed.

However the property is still subject to the terms of the mortgage and payments should be made to. Ad Increasing Mortgage Payments Could Help You Save on Interest. And participate in loan.

Web A Successor in Interest usually occurs when an heir is bequeathed property that is subject to a mortgage. Ad Get Instantly Matched With Your Ideal Mortgage Lender. I did not know you can assume a loan from a decedent borrower if you are deemed Successor in.

You can be the property owner without being liable for making payments. Dispute the lenders accounting. Find A Lender That Offers Great Service.

As the named borrower. Circumstances that may lead to you becoming a Successor in Interest. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms.

Pultemortgageexecutedame

Hometown Oneonta 08 19 16 By All Otsego News Of Oneonta Cooperstown Otsego County Ny Issuu

Successor In Interest Rules Take Effect Smith Debnam Law

Cfpb Final Amendments To Mortgage Servicing Rules Ppt Download

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Understanding Assumable Mortgages Home Loans

Cfpb S Successor In Interest Rules Take Effect April 19 2018 What You Need To Know Lexology

Bulletin Daily Paper 10 28 12 By Western Communications Inc Issuu

05 Cvbj May2014 Finalpaper Lowres By Central Valley Business Journal Issuu

Successors In Interest Revisited

Modeling A Mortgage Loan Assumption Using The All In One Adventures In Cre

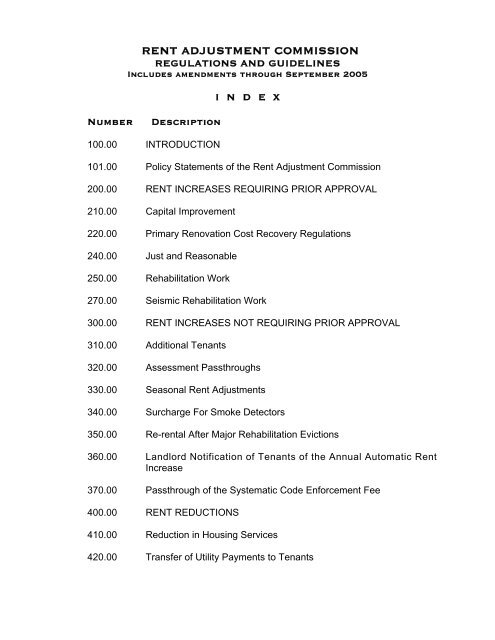

Rent Adjustment Commission California Tenant Law

Op 030719

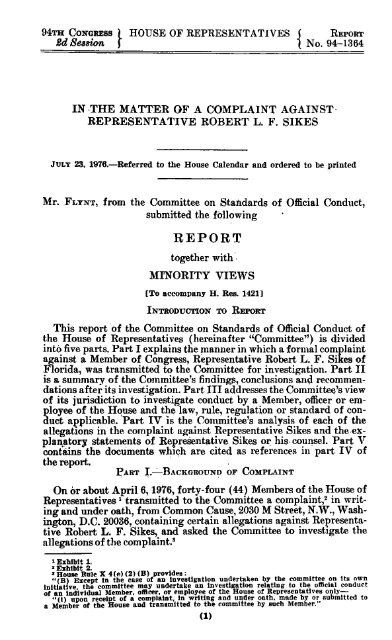

Report House Committee On Ethics U S House Of Representatives

Merrion V Jicarillo Pdf Tribal Sovereignty In The United States Government

Servicer Obligations To Successors In Interest Youtube

Understanding Assumable Mortgages Home Loans