No federal income tax withheld on paycheck 2020

January 24 2021 405 PM. For 2020 the Social Security tax wage base for employees will increase to 137700.

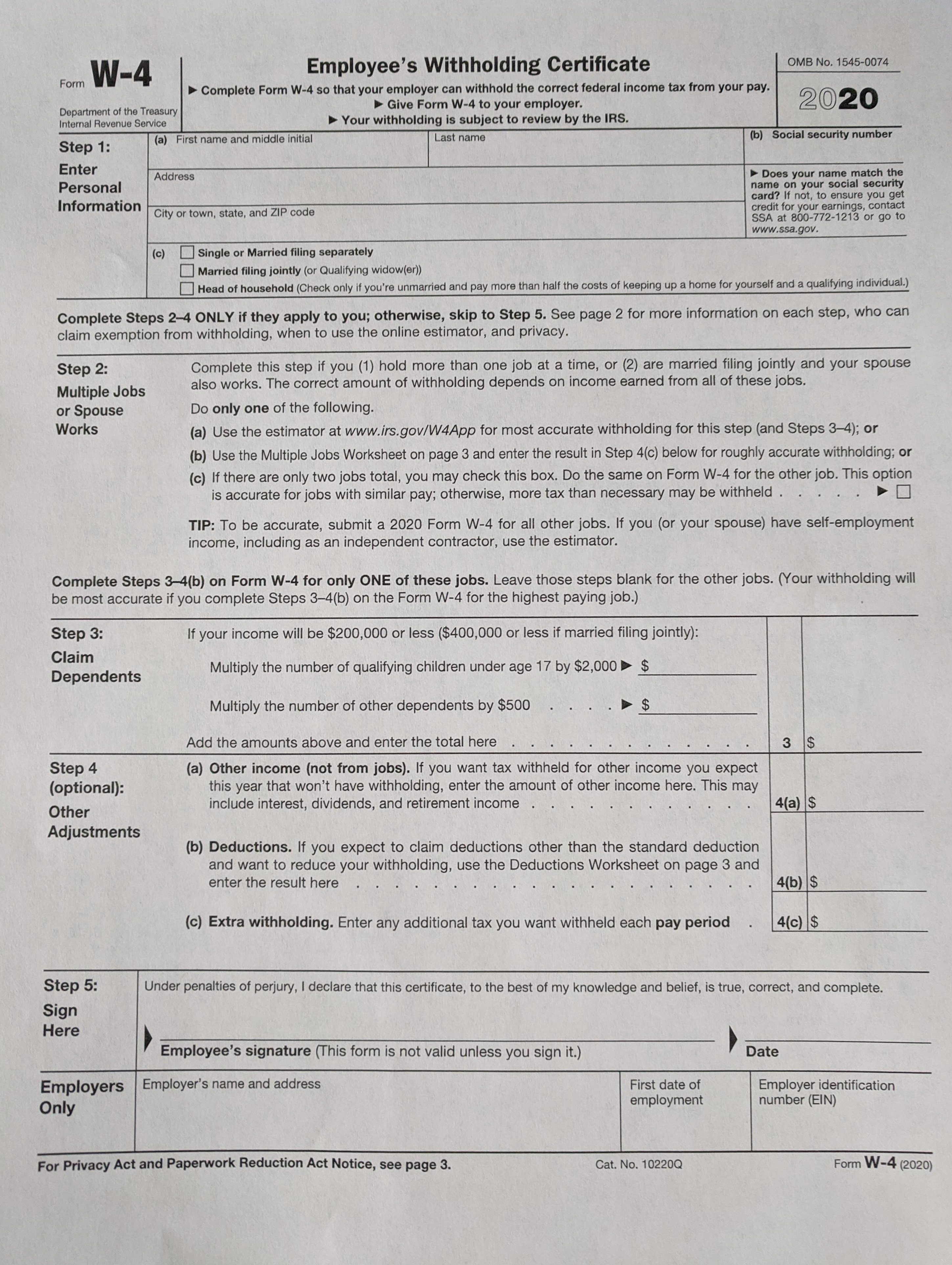

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

Estimate your federal income tax withholding.

. Even if you had as little as 1 in federal tax obligation the previous year you are disqualified from being tax exempt. If youre considered an independent contractor there would be no federal tax withheld from your pay. Employees Withholding Certificate goes into.

The reason is that Congress passed a law in December. Use this tool to. The following are aspects of federal income tax withholding that are unchanged in 2021.

Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019. The percentage of tax withheld from your paycheck depends on what bracket your income falls in. Weve had a few employees that have a couple.

If no federal income tax was withheld from your paycheck the reason might be quite simple. Your employer is responsible for withholding taxes from your check based on the Form W-4 he has on file for you. When you file as exempt from withholding with your employer for federal tax.

For more information on whether or not you can claim an. See how your refund take-home pay or tax due are affected by withholding amount. The IRS has been instructed by the Treasury to not withhold federal income taxes from your paycheck on or after January 1 2022.

Up to 15 cash back Welcome to JUSTANSWERCOM. You didnt earn enough money for any tax to be withheld. Enter the total into Step 4 b 2020 and later Form W-4.

Thanks for using us. - view your pay stub - opt out of paper statements - print your pay stub - update your email address - print your W-2 statement - change your tax withholdings Go To NYS Payroll. The new form called Form W-4.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Go to the Employees menu and choose. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

No withholding allowances on 2020 and later Forms W-4. The IRS made changes to the. The amount of income tax your employer withholds from your regular pay.

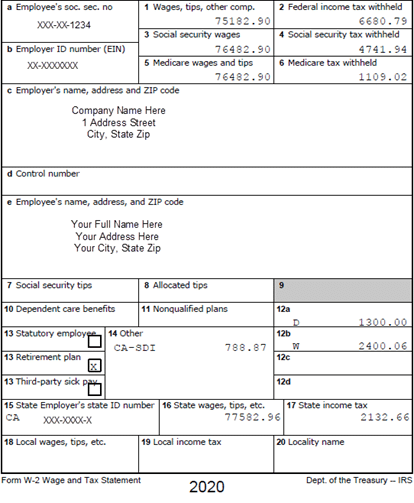

For example for 2021 if youre single and making between 40126 and. For employees withholding is the amount of federal income tax withheld from your paycheck. The Employee Withholding Certificate commonly known as the Form W-4 is an IRS form used by an employer to withhold the correct federal income tax from an.

I hold a Law Degree a BBA an MBA Finance Specialization and CFP CRPS designations as. The solution was to completely redesign how withholding tax is calculated resulting in an entirely new W-4 form. If no federal income tax was withheld from your paycheck the reason might be quite simple.

Weve noticed that employees using the 2020 or later W-4 do not have federal taxes withheld until some threshhold is met. IRS Publication 15-T Federal Income Tax Withholding Methods provides tax tables and worksheets to accommodate tax. If you have created a paycheck thats not calculating the federal withholding deleting and recreating it will do the fix.

Why is there no federal taxes taken out of my paycheck 2022. A taxpayer is still subject to. How It Works.

How much federal tax should be withheld from each paycheck. When you file as exempt from withholding with your employer for federal tax withholding you dont make any federal income tax payments during the year. The Social Security tax rate for employees and employers remains unchanged at.

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

2022 Income Tax Withholding Tables Changes Examples

9 Steps To Adjust Your Tax Withholdings For A Larger Paycheck Finder

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Understanding Your W2 Innovative Business Solutions

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Why No Federal Income Tax Was Withheld From Your Paycheck

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Federal Income Tax

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

How Do I Know If I Am Exempt From Federal Withholding

Understanding Your W 2 Controller S Office

W 4 Form What It Is How To Fill It Out Nerdwallet

New In 2020 Changes To Federal Income Tax Withholding Tilson